Shareholders Return・Dividend Policy

As for profit return to shareholders, our group has a basic policy for deliberating and implementing profit return by balancing internal reserve through comprehensive consideration of business performance, financial status, future business, and investment plans.

The Company's basic policy on dividends of surplus is either once per fiscal year, at the end of the fiscal year, or twice per fiscal year, including interim dividends. Decisions on these dividends of surplus are made by the Board of Directors.

Dividends

As for profit return to shareholders, our group has a basic policy for deliberating and implementing profit return by balancing internal reserve through comprehensive consideration of the following: business performance, financial status, future business, and investment plans.

On October 31, 2023, the Company announced a new shareholder return policy: "Our goal is to maintain a total return ratio, including share buybacks, of more than 80% on a 5-year average starting from the fiscal year ended March 2024.” We intend to return surplus funds to shareholders more proactively than ever before under this policy.

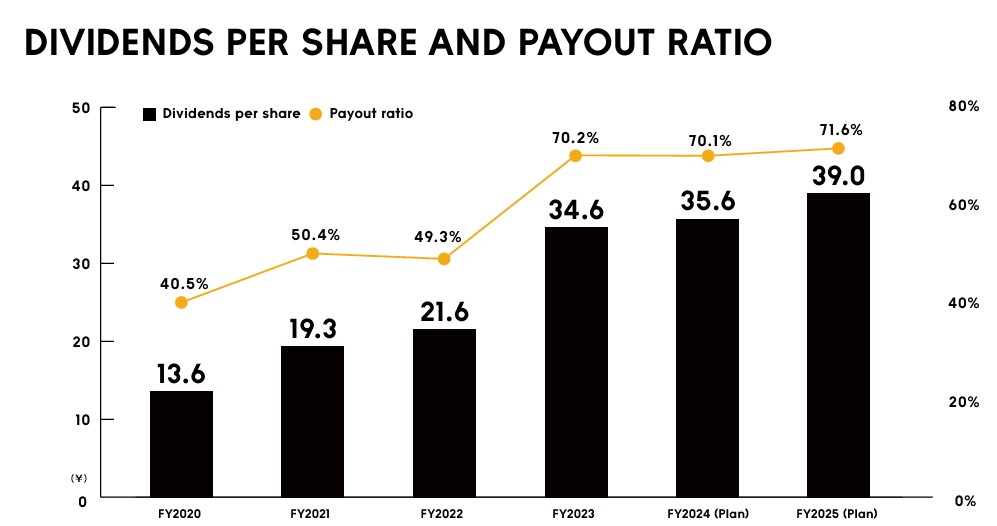

As for the consolidated dividend payout ratio, we will continue to set our target at approximately 70%.

・Dividend for the fiscal year ended March 2025

The dividend for the fiscal year ended March 2025 is as follows. We will continue to maintain a sound financial foundation and strive to enhance corporate value on a continuous basis. Future decisions on retained earnings and profit distribution will be made based on a comprehensive assessment of future business development and other relevant factors.

(Note) On April 1, 2025, the Company conducted a three-for-one stock split of common stock. The dividends for the fiscal years ended March 2025 and April 2024, as stated below, are based on figures before the stock split.

| Annual dividends (yen) | |||

|---|---|---|---|

| End of Q2 | Year-end | Total | |

|

Fiscal year ended March 31, 2025 |

53.00 | 54.00 | 107.00 |

|

Reference: Actual results for the previous fiscal year (Fiscal year ended March 31, 2024) |

49.00 | 55.00 | 104.00 |

・Divident forecast for the fiscal year ending March 31, 2026(Announced on April 30, 2025)

The annual dividend forecast for the fiscal year ending March 2026 is 39.00 yen per share.

(Note) On April 1, 2025, the Company conducted a three-for-one stock split of common stock. The dividend for the fiscal year ending March 31, 2026 (forecast) is based on figures after the stock split.

| Annual dividends (yen) | Payout ratio (Consolidated) | |||

|---|---|---|---|---|

| End of Q2 | Year-end | Total | ||

|

Fiscal year ending March 2026 (Forecast) |

19.00 | 20.00 | 39.00 | 71.6% |

(Note) On April 1, 2025, the Company conducted a three-for-one stock split of common stock. The dividend per share is presented based on the post-stock-split basis. If the stock split is not taken into account, the dividend per share is expected to be 107.0 yen for the fiscal year ended March 31, 2025, and 117.0 yen for the fiscal year ending March 31, 2026.