Corporate Governance

Basic Concept

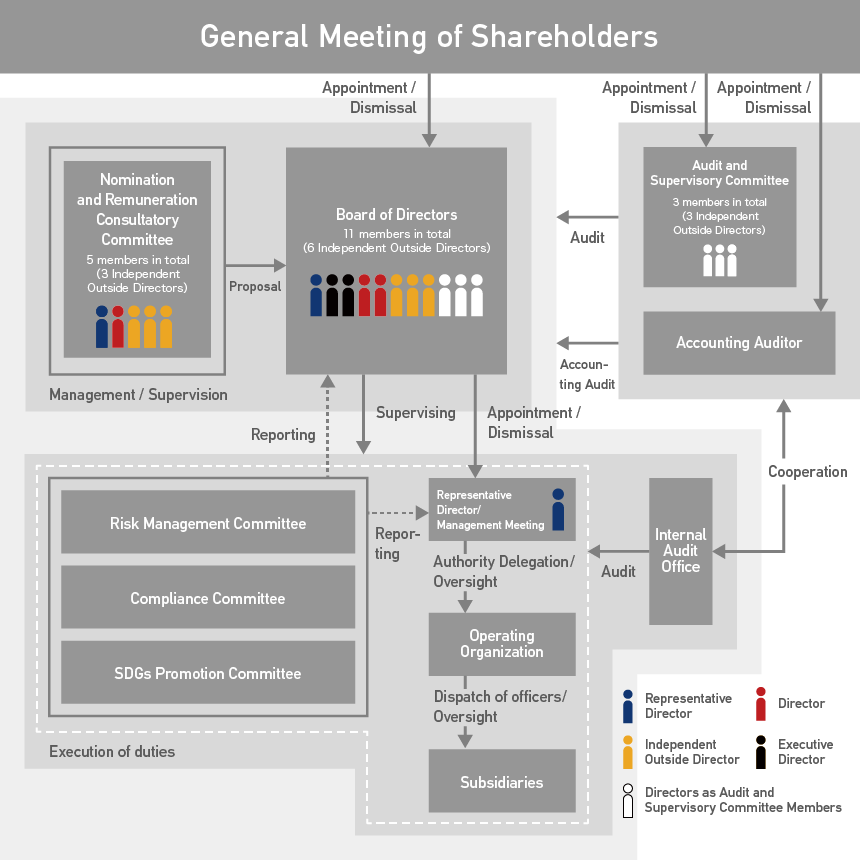

ZOZO Group have the basic policy of management for continuous improvement of corporate value and establish better relationships with all stakeholders including shareholders by constantly focus on integrity, transparency, efficiency and promptness of corporate management. In order to realize this, we are enhancing the corporate governance centered on the Board of Directors and Audit and Supervisory Committee.

Please refer to the following materials for our initiatives in the Corporate Governance Code (Updated on December 16, 2025)

Our Initiatives in Relation to the Corporate Governance Code

As for the Corporate Governance Report, please refer to the following link (Updated on December 16, 2025)

As for more information on the Corporate Governance Code and its implementation status, please refer to the following link.

Corporate Governance Code Content Index

Corporate Governance Structure

Matters Concerning the Executive, Audit and Oversight, Nomination, Remuneration and Other Functions

Board of Directors

Our Board of Directors not only makes decisions on important matters related to business execution but also supervises the duties of the directors, striving to ensure transparency, efficiency, and fairness in decision-making. The total number of directors is 11, of which 6 are external directors (54.5%) and 5 are female directors (45.5%). For more information on the composition of our Board of Directors, please click here. Furthermore, we have currently achieved our KPI goal set to promote the active participation of women: "To increase the ratio of female directors to 30% or more by 2030." The board's implementation status was 19 times in the fiscal year ended March 2024 and 15 times in the fiscal year ended March 2025.

Based on the provisions of Paragraph 1 of Article 427 and Paragraph 1 of Article 423 of the Companies Act, the Company has entered into an agreement with the eight non-executive directors, including six outside directors to limit their liabilities for damages, to the extent provided by laws and regulations in the event they are in good faith and are not grossly negligent.

To enhance business execution and supervisory systems, the Company has established the Nomination and Remuneration Advisory Committee, which is an advisory body to the Board of Directors and is chaired by an independent outside director. The purpose is to strengthen the independence, objectivity, and accountability of the functions of the Board of Directors relating to the nomination of directors, Remuneration, etc.

Number of attendances/attendance rate for the year ended March 31, 2025

| Title | Name | Number of Times Attended (Times) | Attendance Rate (%) |

|---|---|---|---|

| Representative Director, President and CEO of ZOZO Corporation |

SAWADA Kotaro | 15 | 100 |

| Director, Executive Vice President & CFO | YANAGISAWA Koji | 15 | 100 |

| Director, COO | HIROSE Fuminori | 15 | 100 |

| Director | NAGATA Yuko | 14 | 93 |

| Director | HIDE Makoto | 11 | 100 |

| Outside Director | SAITO Taro※ | 14 | 93 |

| Outside Director | KANSAI Takako※ | 15 | 100 |

| Outside Director | OIKAWA Takuya ※ | 11 | 100 |

| Outside Audit and Supervisory Board member | IGARASHI Hiroko※ | 15 | 100 |

| Outside Audit and Supervisory Board member | UTSUNOMIYA Junko※ | 15 | 100 |

| Outside Audit and Supervisory Board member | NISHIYAMA Kumiko※ | 15 | 100 |

- Independent Directors and Audit & Supervisory Board Members in accordance with the provisions of the Tokyo Stock Exchange

- HIDE Makoto and OIKAWA Takuya were appointed at the General Meeting of Shareholders held on June 26, 2024; therefore, their attendance at the Board of Directors meetings (11 meetings) held after their appointment is shown.

Major Sustainability-Related Resolutions and Reports for FY2024

| Governing Body | Key Resolutions and Reports |

|---|---|

| Board of Directors |

Resolutions:

・Current Status of Human Resources (gender ratio / female managers / human resources and training systems, etc.) ・CEO Succession Plan |

Audit and Supervisory Committee, Audit and Supervisory Committee Members

The company has established an Audit and Supervisory Committee as defined under the Companies Act and related laws and regulations. The Audit and Supervisory Committee, consisting of three members who served as outside directors, monitors the operations of the Board of Directors and conducts audits of the day-to-day execution of duties by directors. The Committee members include a qualified attorney and a certified public accountant, who leverage their expertise and experience to effectively oversee the Company’s management. The Audit and Supervisory Committee generally meets once a month.

Audit and Supervisory Committee members attend shareholders' meetings and board of directors' meetings, receive reports from directors, employees, and accounting auditors, as well as exercising their legal rights. In particular, the full-time Audit Committee members conduct effective monitoring by attending important meetings such as the Management Meeting and the Compliance Committee, and conducting audits through interviews with various departments. The Audit Committee members provide opinions to enhance the soundness of the Company's management through their daily audit activities and discussions at the Audit Committee.

Furthermore, the directors who serve on the Audit and Supervisory Committee collaborate with the accounting auditors and the internal Audit Department, exchange opinions with the directors of subsidiaries, and, since November 2019, have been exchanging information with the auditors of the SoftBank Group, thereby conducting effective and efficient audit operations.

Each director serving as an audit committee member has entered into an agreement with the company, based on the provisions of Paragraph 1 of Article 427 and Paragraph 1 of Article 423 of the Companies Act, limiting their liability for damages to the amount specified by law, provided that such liability arises from acts or omissions made in good faith and without gross negligence.

| Title | Name | Number of Times Attended (Times) | Attendance Rate (%) |

|---|---|---|---|

| Outside Audit and Supervisory Board member (Full-time) | IGARASHI Hiroko※ | 14 | 100 |

| Outside Audit and Supervisory Board member | UTSUNOMIYA Junko※ | 14 | 100 |

| Outside Audit and Supervisory Board member | NISHIYAMA Kumiko※ | 14 | 100 |

- Independent Directors and Audit & Supervisory Board Members in accordance with the provisions of the Tokyo Stock Exchange

Management Meeting

The Management Meeting consists of Directors who are not Audit and Supervisory Committee Members and Executive Officers, and Outside Directors, General Managers, a full-time Audit and Supervisory Committee Member, and the Representative Director of subsidiaries, and persons in charge of matters to be discussed join the meeting as observers. In principle, the Management Meeting is held twice a month to conduct resolutions, deliberations, and reports based on the authority approval standards. In addition, the Management Meeting members discuss business reports based on the management policy, related information, analysis of that information, information sharing between departments, business plans and directions related to the entire business, and issues each business unit addresses, especially matters that should be discussed across the organization. A Management Meeting is held to facilitate the decision-making process for the Representative Director and other decision-makers, based on the authority approval standards.

The Management Meeting makes resolutions, deliberations, and reports based on the decision-making authority standards. The Management Meeting also collects and analyzes business reports in accordance with the Company's management policies and important information on these matters, shares information among departments, and conducts business plans, as well as matters to be discussed across the organization in terms of policies related to the overall business and issues faced by each business division. These meetings are implemented to contribute to decision-making by the representative directors and decision-makers based on the decision-making authority standards.

Nomination and Remuneration Advisory Committee

The Company established the Nomination and Remuneration Consultatory Committee to express opinions to the Board of Directors on the nomination and remuneration of Directors.

The Nomination and Compensation Advisory Committee consists of five members: all independent outside directors who are not members of the Audit and Supervisory Committee (provided, however, that if there are two or fewer such directors, the committee shall consist of all independent outside directors who are not Audit and Supervisory Committee members and one independent outside director who is a member of the Audit and Supervisory Committee), one director dispatched from the parent company, and one executive director who is not dispatched from the parent company. The committee is chaired by an outside director.[Among them, three (60.0%) are independent officers as defined by the Tokyo Stock Exchange.]

Based on the Nomination and Compensation Advisory Committee Rules established by the Board of Directors, the committee deliberates and provides opinions to the Board on matters such as:

・Proposals for the appointment and dismissal of directors to be submitted at the General Meeting of Shareholders,

・Appointment and dismissal of the President, CEO, and Representative Director,

・Succession planning for the President and CEO,

・Remuneration and bonuses for directors (excluding non-executive and outside directors),

and all other related matters,taking into account each fiscal year’s performance and contributions to such performance.

The Nomination and Remuneration Advisory Committee consists of the following:

| SAITO Taro | Outside Director (Chairperson) |

| KANSAI Takako | Outside Director |

| OIKAWA Takuya | Outside Director |

| SAWADA Kotaro | Representative Director, President & CEO |

| HIDE Makoto | Director (Non-Executive) |

[Nomination and Remuneration Advisory Committee]

- Status of Activities

In the year ended March 31, 2025, five meetings were held. - Major Deliberations

- Evaluation of Current Directors

- CEO succession planning considerations

- Composition and Roles of Executive Directors

- Directors' Remuneration (Cash Bonuses)

- Number of Times Attended and Attendance Rate

| Title | Name | Number of Times Attended (Times) | Attendance Rate (%) |

|---|---|---|---|

| Outside Director | SAITO Taro※ | 5 | 100 |

| Outside Director | KANSAI Takako※ | 5 | 100 |

| Outside Director | OIKAWA Takuya※ | 4 | 100 |

| President and CEO | SAWADA Kotaro | 5 | 100 |

| Director (Non-Executive) | HIDE Makoto | 4 | 100 |

- Independent Directors and Audit & Supervisory Board Members in accordance with the provisions of the Tokyo Stock Exchange

- OIKAWA Takuya and HIDE Makoto were appointed at the General Meeting of Shareholders held on June 26, 2024; therefore, their attendance at the Board of Directors meetings (4 meetings) held after their appointment is shown.

Internal Audit Office

The Internal Audit Office, in collaboration with the Audit and Supervisory Committee Members and accounting auditor, strives to improve the effectiveness and efficiency of internal controls, compliance, etc. by conducting hearings and on-site surveys of each business division in accordance with the annual internal audit plan.

Auditing Firms, etc.

- Name of the auditing corporation

Deloitte Touche Tohmatsu Limited. - Certified Public Accountants leading the independent financial audit

NUMATA Atsushi

OKUDA Hisashi - Assistant Organization in Audit Activities

Audit assistants engaged in accounting audits are five certified public

accountants and 24 others.

Evaluation of the Effectiveness of the Board of Directors

Regarding the effectiveness of the Board of Directors, the Company's Board of Directors annually analyzes and verifies items related to the purposes, agendas, composition, discussions, and operation of the system supporting the Board of Directors. They also examine and address issues based on the results of the analysis and verification.

Please see below for details on the results of the evaluation of the effectiveness of the Board of Directors.

Evaluation of the Effectiveness of the Company's Board of Directors

Matters Concerning Takeover Defense

We recognize that the most important issue for our company is to sustain continuous growth and improve our corporate value. At this stage, we have no plans to implement takeover defense measures.

Status of Stock Ownership by Officers

|

Title |

Name |

Number of Company Shares Owned |

|

Representative Director, President and CEO of ZOZO Corporation |

SAWADA Kotaro |

242,700 |

| Director, Executive Vice President & CFO |

YANAGISAWA Koji |

494,700 |

| Director, COO |

HIROSE Fuminori |

180,150 |

|

Director |

HIDE Makoto | ー |

| Director |

NAGATA Yuko |

ー |

| Outside Director |

SAITO Taro |

ー |

| Outside Director |

KANSAI Takako |

ー |

| Outside Director |

OIKAWA Takuya |

ー |

|

Outside Audit and Supervisory Board member |

IGARASHI Hiroko |

ー |

| Outside Audit and Supervisory Board member |

UTSUNOMIYA Junko |

9,000 |

|

Outside Audit and Supervisory Board member |

NISHIYAMA Kumiko |

ー |

Policy on Determining Remuneration/ Compensation Amounts and Calculation Methods

1. Purposes of remuneration/ compensation

Remuneration/ compensation for Directors consists of fixed remuneration (cash remuneration) and performance-linked compensation (cash bonus/stock compensation). They are paid for efforts to achieve short-term, and medium- to long-term business results and increases in corporate value. The results are measured based on the Company’s management strategy to promote a medium- to long-term sustainable increase in corporate value and function as a sound incentive.

2. Level of remuneration/ compensation

After establishing a group of companies as a benchmark for remuneration, a certain level and composition of remuneration/ compensation are prepared so that the Company can ensure and retain excellent human resources over competitors in terms of business and recruiting, assuming that the remuneration is attractive for current and prospective officers and their candidates.

3. Composition of remuneration/ compensation

The ratio of performance-linked compensation exceeds the percentage of fixed remuneration, and among the performance-linked compensation, the proportion of stock compensation shall be more than a cash bonus. The Company's policy is to pay only fixed remuneration to non-executive Directors, which includes Outside Directors, of the Board of Directors (excluding Directors who are the Audit and Supervisory Committee Members).

a. Cash remuneration Fixed remuneration is determined according to the title and duty of the eligible persons and paid during their term of office.

b. Cash bonus (short-term incentive remuneration) Cash bonus represents performance-linked compensation based on the achievement of the short-term performance goal for each fiscal year. The Gross Merchandise Value, an indicator of potential business growth, and consolidated operating profit, an indicator of profitability, are designated as criteria for the payment of remuneration. A specific payment amount is determined based on the achievement of a performance goal set out in the single-year plan and the title and duty of the eligible persons, and is periodically paid during the term of office.

c. Stock compensation (medium- to long-term incentive compensation) Stock compensation represents performance-linked compensation for promoting the management that focuses on medium- to long-term increases in corporate value/shareholder value, and stock with restrictions on transfer is granted to the eligible persons. The ratio to release the restrictions on transfer is determined based on the continuous service of the Company's Board of Directors, the Company’s stock price growth rate for three fiscal years (compared with those of a group of about 27 benchmark companies), consolidated operating profit, and the valuation score granted by the ESG rating provider that the Company determines. Fundamentally, the stock is annually granted to eligible persons according to their titles and duties.

4. Matters concerning the determination of the details of remuneration/ compensation for respective Directors

The Nomination and Remuneration Consultatory Committee examines the draft and its consistency with the policy from various perspectives. The Board of Directors also believes that the draft complies with the policy for determination and fundamentally respects the report from the committee.

5. Other significant matters concerning the determination of the remuneration/ compensation of respective

Directors For stock compensation, the provision is established that the Company acquires all or a part of the stocks allocated to the eligible Directors without charge in the event the relevant Directors resigns before the 15 expiration of the period of transfer restriction for reasons other than reasons the Board of Directors thinks due and other cases that the relevant Directors commit events, such as specific illegal activities.

In addition, the provision is established for making the applicable Directors return all or a part of stocks with restrictions on transfer or cash equivalent to the Company without charge when certain events are identified, including errors in the figures providing a basis for calculating the ratio of releasing the restrictions on transfer, and the Company considers the above return due. In addition, the remuneration of Directors who are Audit and Supervisory Committee Members is determined by discussion among the Audit and Supervisory Committee Members within the limit of the total amount of remuneration for Directors who are Audit and Supervisory Committee Members as resolved at the General Meeting of Shareholders.

Directors' Remuneration

Introduction of a Performance-Linked Remuneration System

The Nomination and Remuneration Advisory Committee, which is an advisory body to the Board of Directors and is composed mainly of outside directors, has been considering reviewing the remuneration system for directors. Based on the results of the deliberations and their reports, we have introduced the remuneration system for the executive directors of the Company to pay for their efforts to achieve short-term and medium-to long-term performance and increase corporate value based on our management strategy, and for their achievements, with the aim of encouraging the sustainable, medium-to long-term improvement of corporate value and functioning as a sound incentive. Specifically, it consists of fixed remuneration and performance-linked remuneration. Fixed remuneration consists of only cash and performance-linked remuneration consists of two types of remuneration: cash bonuses and stock-based remuneration. With regard to the percentage of each remuneration, the percentage of performance-linked remuneration exceeds the percentage of fixed remuneration, and the percentage of stock-based remuneration exceeds the percentage of cash bonuses among performance-linked remuneration.

In addition, "ESG evaluation indicators" will be introduced in FY2023 to determine stock remuneration, which will be based on "stock price growth rate," "operating income," and "enrollment requirements" to measure business growth and "ESG evaluation indicators" to measure the degree of promotion of ESG management. The evaluation criteria will be reviewed every three fiscal years.

Outline of Executive Remuneration System

| Remuneration Items | Remuneration Ratio | Evaluation Standards | Target | ||||

| Fixed remuneration (cash remuneration) | 30% | ー | ー | ||||

|

Cash bonuses |

30% |

Gross Merchandise Value |

618,067 million yen※ |

||||

|

Operating Profit |

69,386 million yen※ |

||||||

|

Stock Remuneration |

40% |

Stock Price Growth Rate Operating Profit Enrollment Requirement |

Top 25% of peer group companies |

||||

|

ESG evaluation indicators |

MSCI ESG RATINGS:AAA |

- Equivalent to 108% of the disclosed budget

- Target for fiscal 2024

Remuneration

- Total remuneration paid to directors (of which, outside directors) 394 million yen (21 million yen)

- Total amount by type of remuneration, etc.

| Monetary remuneration | Fixed remuneration | 165 million yen (21 million yen) |

| Bonus | 72 million yen (-) | |

| Non-monetary remuneration | Restricted stock | 160 million yen (-) |

- Number of eligible directors: 6 (including 3 outside directors)

- As of the end of the fiscal year under review, there were eight directors (of whom three were outside directors). The reason for the difference in the number of directors is that there are two non-compensated directors.

- Bonuses are the amount of provision for accrued bonuses to directors and Audit and Supervisory Board members for the current fiscal year. Details of performance indicators selected as the basis for calculating bonus amounts are merchandise transaction value and consolidated operating income. The reason we selected these performance indicators was that we emphasize merchandise transaction volumes and consolidated operating income as indicators of the growth and profitability of our Group's businesses.

- Performance-linked restricted stock are granted to directors as non-monetary remuneration.

- Under the performance-linked restricted stock plan, we have introduced a malus and clawback clause. Specifically, before the expiration of the transfer restriction period, the Company may forfeit the remuneration in the event that the relevant Director engages in certain misconduct, resigns for reasons other than those deemed legitimate by the Board of Directors, or if a material restatement of the Company’s financial statements occurs. Furthermore, after the transfer restrictions on the shares have been lifted, if it is discovered that there was an error in the calculation of the remuneration or that the relevant Director committed a material misconduct, the Company may require the return of the shares or an equivalent amount in cash or other assets, as deemed appropriate by the Company.

Reasons for the Selection of Directors and

Audit and Supervisory Committee members

SAWADA Kotaro, Representative Director, President and CEO

SAWADA Kotaro has been chosen as a Director because he has been involved in important business execution and management decision-making and supervision as the person responsible for the marketing section, after also serving as a Representative Director of a subsidiary since joining the Company. In addition, He has served as the Company's representative since September 2019 and has worked to ensure prompt and flexible decision-making in business operations. As he is suitable for the future growth of the group and the realization of the Company's philosophy, he has served as a Director.

YANAGISAWA Koji, Director, Executive Vice President & CFO

As Director and General Manager of the Business Administration Division, YANAGISAWA Koji has strengthened the Company's managerial foundation through supervising accounting, finance, IR, legal, and other areas of management, overseeing risk management, corporate governance, M&As, and other responsibilities. In addition, he executes business operations as a Director and Vice-President, and we have chosen him as a Director because we expect him to perform his duties based on a wide range of perspectives in the future as well as a member of the Board of Directors.

HIROSE Fuminori, Director, COO

Since joining the Company, HIROSE Fuminori has served as Head of Internal Audit Office, Executive Officer and General Manager of Business Administration Division, and Executive Officer and General Manager of EC Business Division and has a wide range of experience and knowledge of the Company's business, overall business administration, and risk management. In addition, he has contributed to the Company's business growth as a Director and COO of the Company since June 2021. We have chosen him as a Director because we expect him to contribute to the enhancement of the corporate value of the Company.

HIDE Makoto, Director

HIDE Makoto has abundant experience and broad insight gained through business operations in the Internet service industry and corporate management at the parent company's group companies, and was elected as a Director of the Company in order to utilize his experience and insight in the management of our group.

NAGATA Yuko, Director

NAGATA Yuko possesses extensive experience and broad knowledge of marketing strategies in the internet service and cosmetics industries, was elected as a Director of the Company in order to utilize his experience and insight in the management of our group.

SAITO Taro, Outside Director

SAITO Taro possesses extensive experience and broad insights in branding and communication design, having served as both an outside and an inside director at several companies. We appointed him as an outside director to strengthen corporate governance by advising on management strategy and business execution, participating in nomination and remuneration decisions, and overseeing conflicts of interest.

KANSAI Takako, Outside Director

KANSAI Takako possesses expertise in both business management and technology. We appointed her as an outside director to strengthen corporate governance by advising on management strategy and business execution, participating in nomination and remuneration decisions, and overseeing conflicts of interest.

OIKAWA Takuya, Outside Director

OIKAWA Takuya possesses deep understanding of product and engineering management in the IT and internet industries. We appointed him as an outside director to strengthen corporate governance by advising on management strategy and business execution, participating in nomination and remuneration decisions, and overseeing conflicts of interest.

IGARASHI Hiroko, Outside Audit and Supervisory Board member

IGARASHI Hiroko, a certified public accountant, possesses considerable knowledge of finance, accounting, and risk management, having served for several years as the head of an accounting department at a company engaged in the data center business. Although she has not been directly involved in the management of the Company except for becoming an Outside Officer, We believe that she is well qualified to appropriately perform the duties of an Audit and Supervisory Committee member and have therefore appointed her to the position.

UTSUNOMIYA Junko, Outside Audit and Supervisory Board member

UTSUNOMIYA Junko possesses considerable expertise in corporate legal affairs and is expected to contribute to the Company by providing legal oversight from a professional standpoint. Although she has not been directly involved in the management of the Company except for becoming an Outside Officer, We believe that she is well qualified to appropriately perform the duties of an Audit and Supervisory Committee member and have therefore appointed her to the position.

NISHIYAMA Kumiko, Outside Audit and Supervisory Board member

KUMIKO Nishiyama, a certified public accountant, possesses broad insights gained through her work in risk management and sustainability-related roles. Although she has not been directly involved in the management of the Company except for becoming an Outside Officer, We believe that she is well qualified to appropriately perform the duties of an Audit and Supervisory Committee member and have therefore appointed her to the position.

View Directors and Officers

Directors’ skills matrix

The expertise, knowledge, and experience that directors are expected in responding to current or future management issues against the business environment at the company are as follows.

| Name | Title | Important expertise, knowledge, and experience for Decision-making and Monitoring of the Board of Directors |

Important expertise, knowledge, and experience in Responding to Current and Future Management Issues | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Corporate Management・ Management Strategy | Finance・M&A | Treasury・Accounting | Organization・Human Resources | ESG・Sustainability | Corporate Governance | Compliance・Risk Management | Brand Strategy・Creative Strategy | (IT・Digital)Technology | Same Business・Same Industry | SupplyChain | Global Management・Business | Imagination and Creation※ | ||

| SAWADA Kotaro | Representative Director, President & CEO | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||

| YANAGISAWA Koji | Director, Executive Vice President & CFO | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||

| HIROSE Fuminori | Director, COO | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||

| HIDE Makoto |

Director | ● | ● | ● | ● | ● | ||||||||

|

NAGATA Yuko |

Director | ● | ● | ● | ● | ● | ||||||||

| SAITO Taro | Outside Director | ● | ● | ● | ● | |||||||||

| KANSAI Takako | Outside Director | ● | ● | ● | ● | ● | ● | |||||||

| OIKAWA Takuya |

Outside Director | ● | ● | ● | ● | ● | ● | ● | ||||||

| IGARASHI Hiroko | Audit and Supervisory Committee Members | ● | ● | ● | ● | ● | ||||||||

| UTSUNOMIYA Junko | Audit and Supervisory Committee Members | ● | ● | ● | ● | ● | ● | |||||||

| NISHIYAMA Kumiko | Audit and Supervisory Committee Members | ● | ● | ● | ● | ● | ● | |||||||

- ”Imagination and Creation” is translation of our original Japanese word “SOZO.” It stands for the ability to create new value, cultural values, and all types of excitement and surprise. In addition, this table does not represent all the knowledge and experience possessed by each director.