Market Environment

< Fashion and Apparel Market >

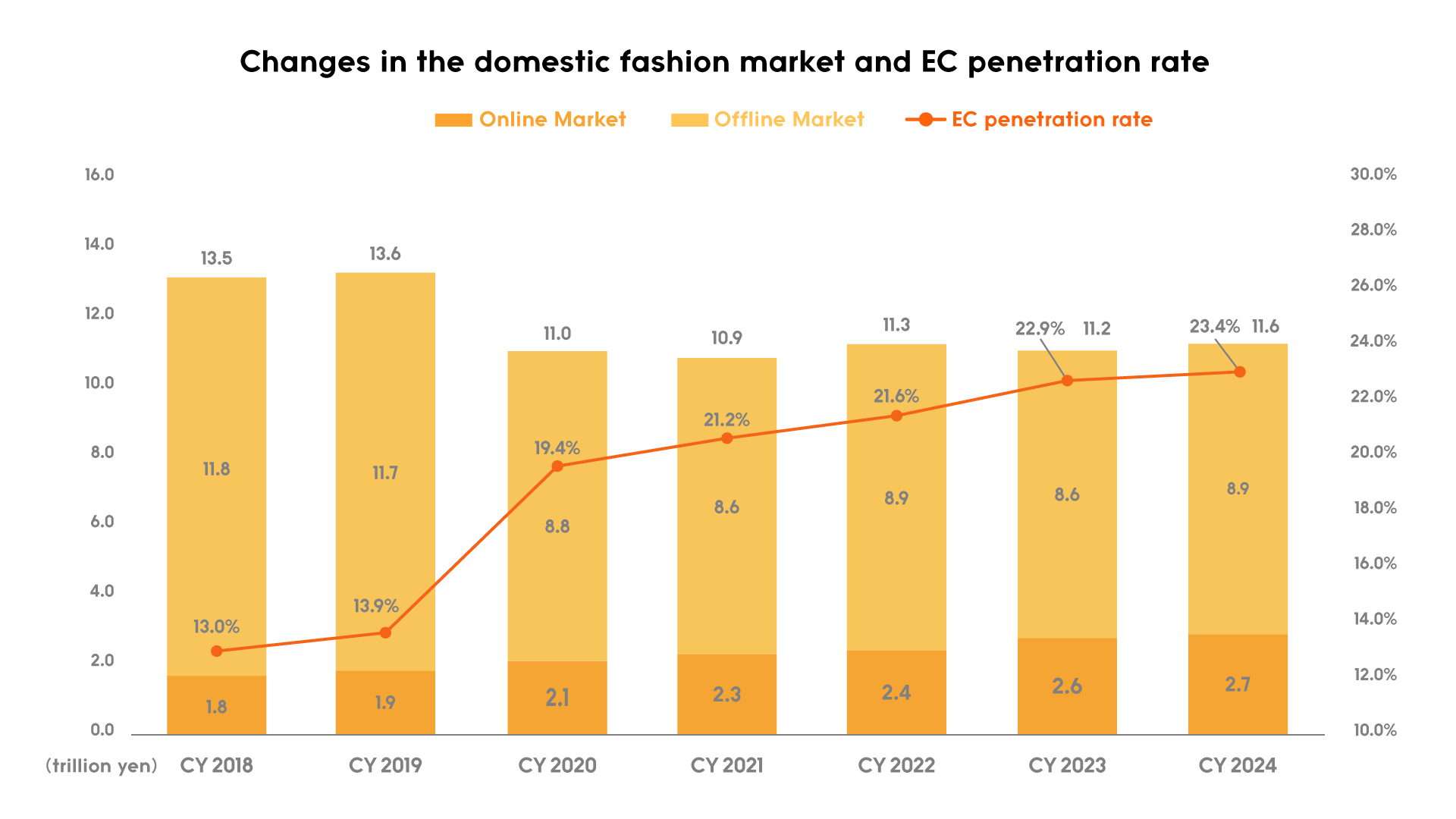

The domestic market for clothing and personal belongings (apparel, shoes, footwear, Japanese/Western umbrellas, bags, trunks, handbags, sewing supplies, jewelry, and accessories excluding precious metals) is expected to be worth approximately 11.6 trillion yen in 2024, of which the fashion e-commerce market is assumed to be worth approximately 2.7 trillion yen. (Our estimate is based on “Current Survey of commerce, FY2024 E-Commerce Market Survey” published by the Ministry of Economy, Trade and Industry) Although the overall size of the fashion retail market, including offline stores, shrank due to the spread of COVID-19, the e-commerce market continued to grow and rapidly shifted online. However, the ratio of the e-commerce market to the total fashion retail market (hereinafter referred to as "EC penetration") is about 23% in Japan, while it is around 30% in Europe and the U.S. This suggests that there is still much room for growth.

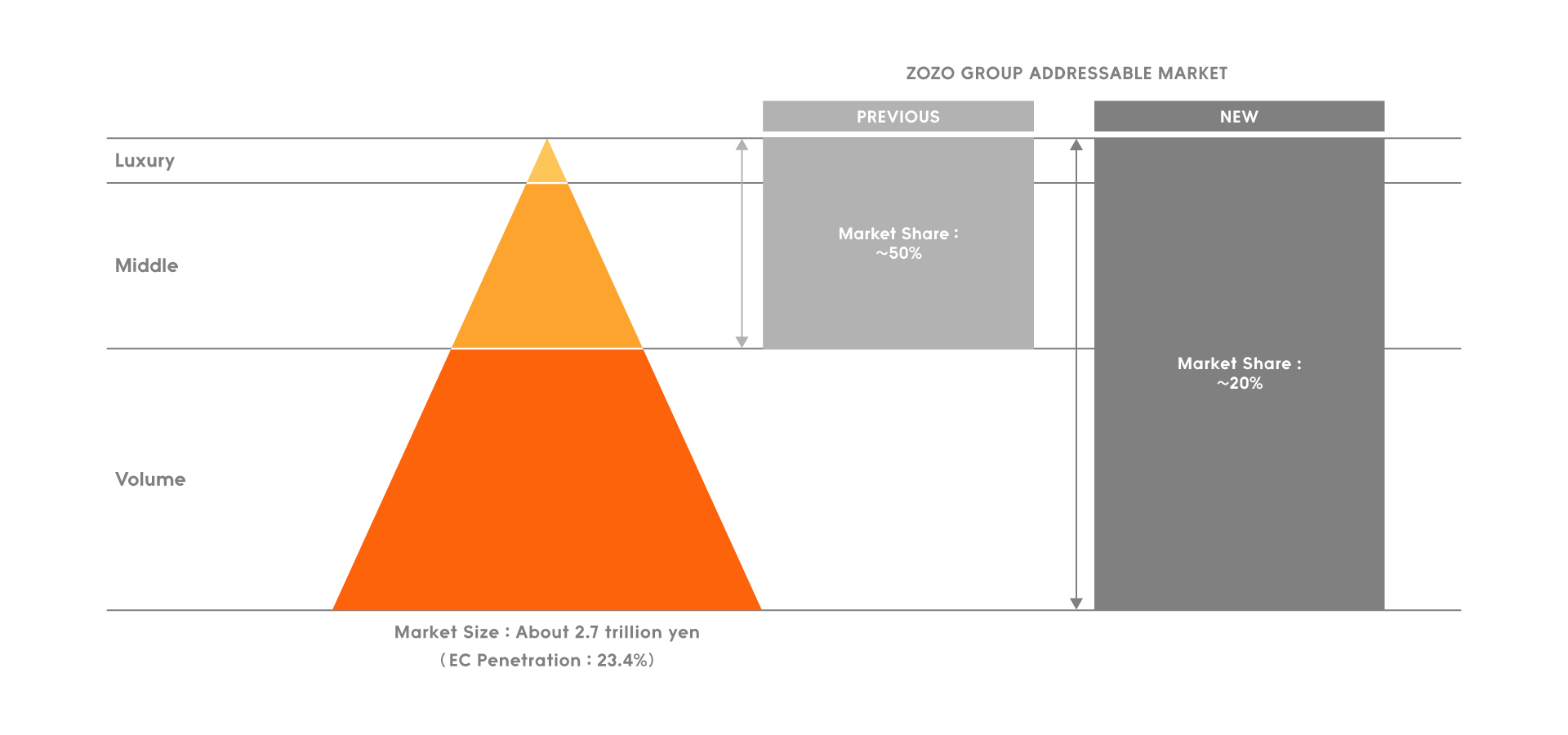

We classify the fashion e-commerce market into three areas: high price range, medium price range, and low price range.

Since our establishment, we had been building up our brand portfolio by opening stores mainly in the high and medium price range. Additionally, we have been attracting brands in the low price range to meet diversifying needs. We will strive to attract more brands without limiting the price range.

Based on an estimate that the fashion e-commerce market size is approximately 2.7 trillion yen, it can be said that our market share in terms of Gross Merchandise Value (excluding other GMV) is still around 20%. We will strive to acquire further growth opportunities by increasing the number of brands while paying close attention to our website’s branding, as well as increasing the number of buyers.

- In estimating the market share, we used the figures published from January 2024 to December 2024 for comparison.

< Cosmetics Market >

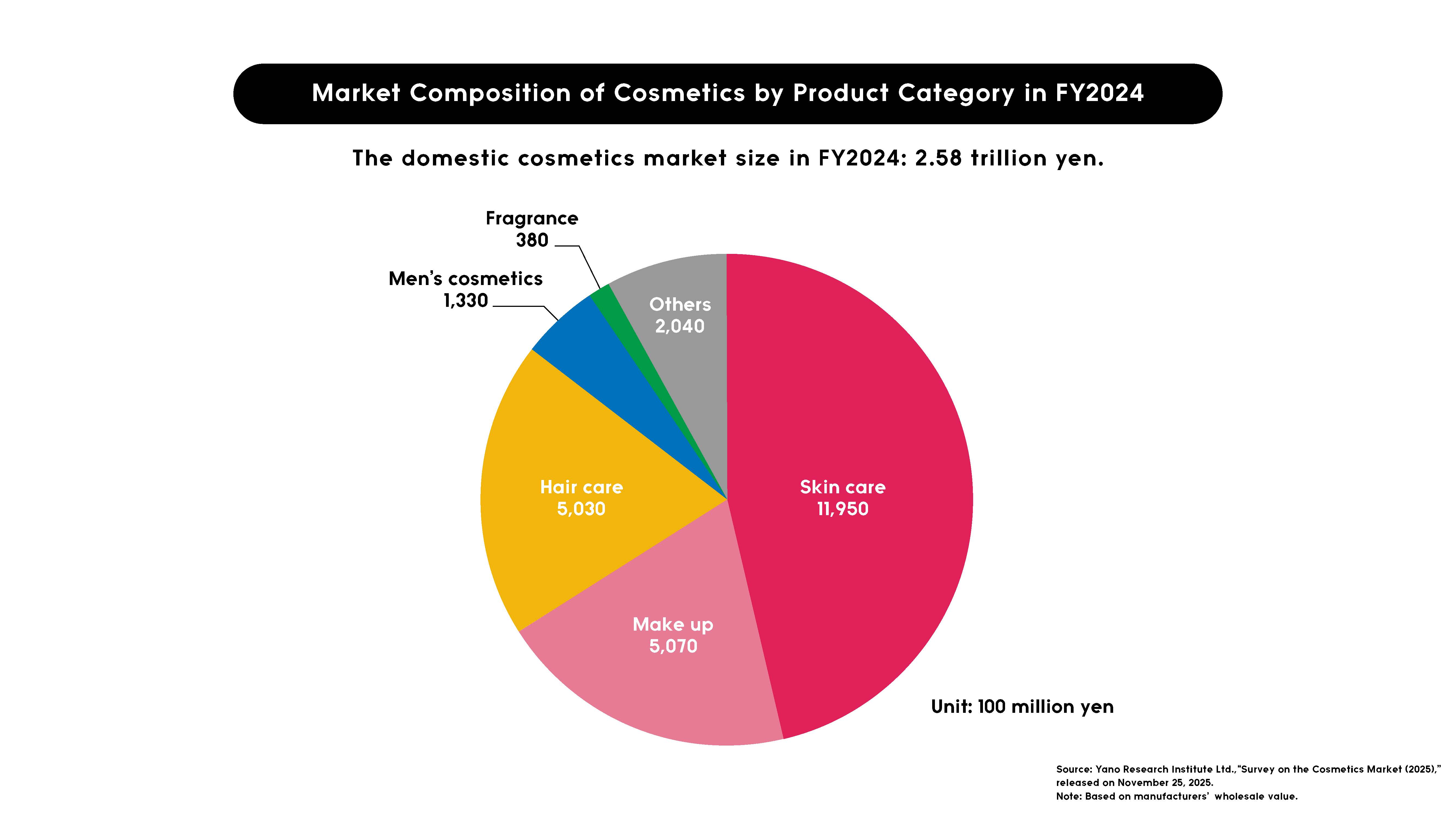

The domestic cosmetics market is estimated to be worth approximately 2.6 trillion yen in FY2024*. Opportunities for going out have increased, leading to higher demand for cosmetics. Additionally, the premiumization of cosmetics is progressing and inbound demand is showing signs of recovery, resulting in year-on-year growth of approximately 104.1%. From FY2025 onward, unit prices are expected to improve due to the shift toward higher value-added products, and the recovery in inbound demand is also expected to continue as the number of tourists visiting Japan increases. Thus, further market expansion is expected.

- Source: Yano Research Institute Ltd., “Survey on the Cosmetics Market (2025),” released on November 25, 2025.

Note: Based on manufacturers’ wholesale value.

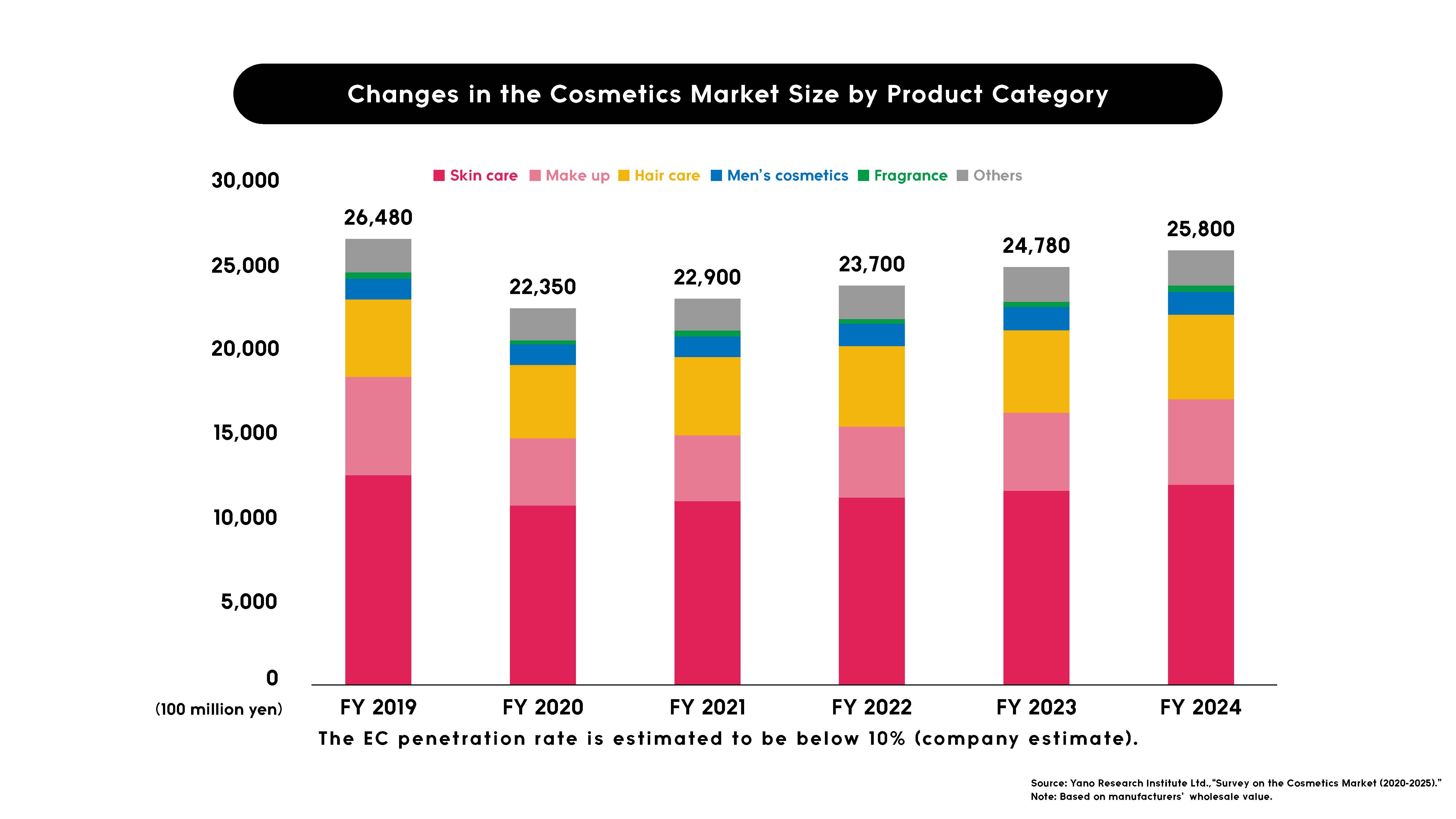

Like the fashion retail market, the cosmetics market also experienced a rapid shift to e-commerce, which was affected by the spread of COVID-19. On the other hand, the EC penetration rate in FY2024 is less than 10%, which is even lower than that of the fashion retail market (our estimate is based on FY2024 E-Commerce Market Survey published by the Ministry of Economy, Trade and Industry).

We began handling cosmetics in March 2021. We are attracting a wide range of both domestic and international cosmetics brands. We will strive to grow this business by leveraging the compatibility with existing users who purchase fashion/apparel items.